Who Are We?

Gasoline is one of the major fuels consumed in the United States, and it is the main product refined from crude oil. About 10% of the volume of finished motor gasoline now consumed in the United States is ethanol. In 2014, gasoline (including fuel ethanol) accounted for about 65% of all the energy used for transportation, 47% of all petroleum consumption, and 17% of total U.S. energy consumption. Americans used about 375 million gallons of gasoline per day in 2014. With about 319 million people in the United States in 2014, that calculates to more than a gallon of gasoline every day for each person About 45 barrels of gasoline are produced in U.S. refineries from every 100 barrels of oil refined to make petroleum products.

The primary use for gasoline is in automobiles and light trucks, and farm, recreational and other equipment. While gasoline is produced year-round, extra volumes are made in time for the summer driving season. Gasoline is delivered from oil refineries mainly through pipelines to a massive distribution chain serving 2,977 convenience stores in Mississippi and 127,588 convenience stores throughout the United States. There are three grades of gasoline: regular, mid-grade and premium. Each grade has a different octane level. Price levels vary by grade, but the price differential between grades is generally constant.

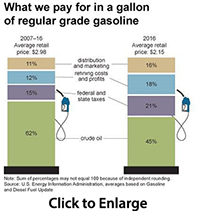

The components of the retail price of gasoline.

The retail price of gasoline includes four main components:

Retail pump prices reflect these costs, as well as the profits (and sometimes losses) of refiners, marketers, distributors, and retail station owners.

What determines the cost of crude oil?

The cost of crude oil is the major contributor to the retail price of gasoline. The cost of crude oil as a share of the retail gasoline price varies over time and also varies among regions of the country. Crude oil prices are determined by both demand and supply. World economic growth is the most significant factor affecting demand. Oil prices often increase in response to disruptions in the international and domestic supply of crude oil. A major factor in supply is the Organization of the Petroleum Exporting Countries (OPEC), which can sometimes exert significant influence on oil prices by setting an upper production limit on its members. OPEC produced about 42% of the world's crude oil from 2000 to 2014. OPEC countries maintain nearly all of the world's spare oil production capacity, and possess almost three fourths of the worlds estimated proved crude oil reserves. Increases in U.S. oil production in the past several years have helped to reduce upward pressure on oil and gasoline price.

Refining costs and profits

Refining costs and profits comprise about 10% of the retail price of gasoline nationally for 2014. Refining costs and profits vary seasonally and by region in the United States, partly because of the different gasoline formulations required to reduce air pollution in different parts of the country. The characteristics of the gasoline produced depend on the type of crude oil that is used and the type of processing technology available at the refinery where it is produced. Gasoline prices are also affected by the cost of other ingredients that may be blended into the gasoline, such as ethanol. Increased demand for gasoline in the summer generally results in higher prices.

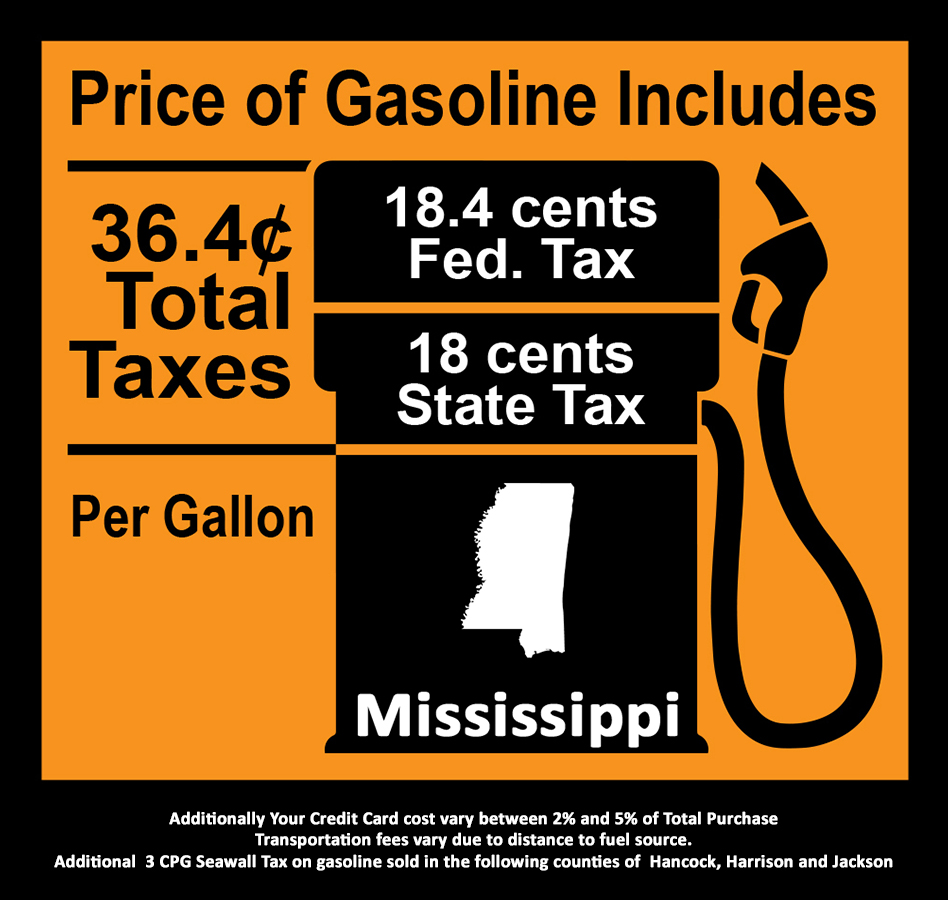

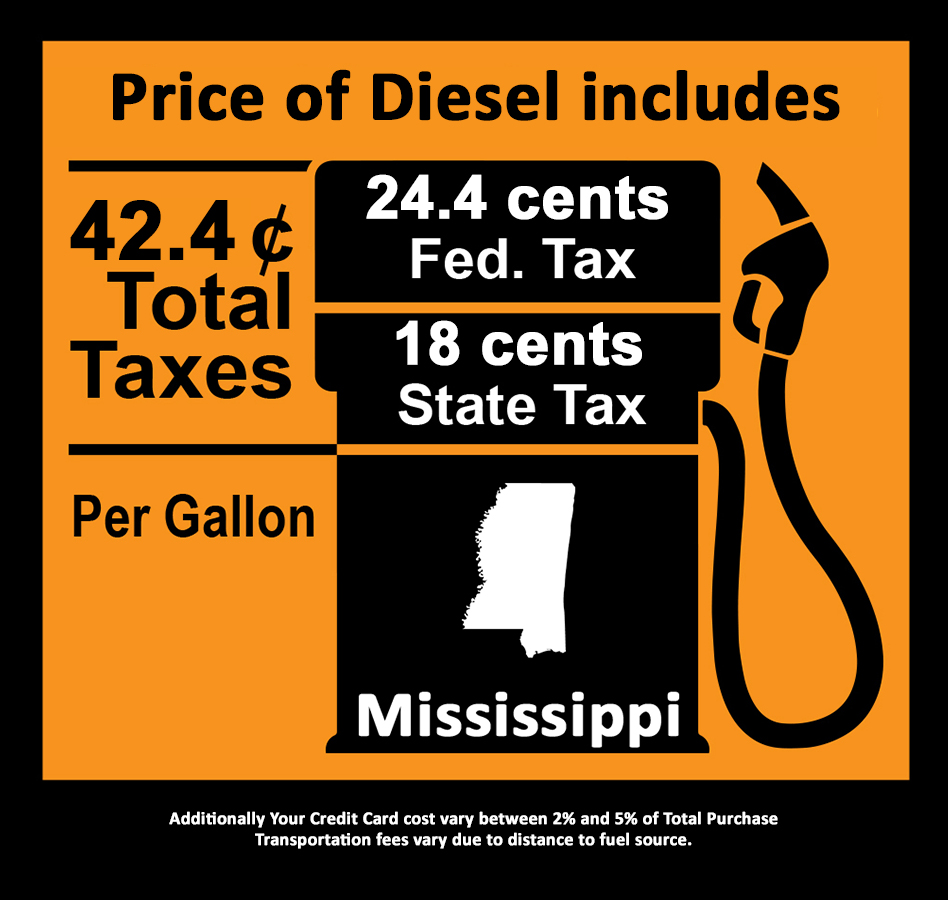

Taxes add to the price of gasoline

Federal, state and local taxes are a large component of the retail price of gasoline. Taxes (not including county and local taxes) account for approximately 13% percent of the cost of a gallon of gasoline nationally for 2014. Within this nation average, are federal excise taxes of 18.4 cents per gallon. As of July 1, 2014, state excise taxes averaged 24.12¢ per gallon. Also, twelve states levy additional state sales taxes and other taxes, some of which are applied to the federal and state excise taxes. Additional local county and city taxes can have a significant impact on the price of gasoline.

Distribution and marketing

Distribution, marketing and retail dealer costs and profits combined make up 12% of the cost of a gallon of gasoline nationally for 2014. From the refinery, most gasoline is shipped first by pipeline to terminals near consuming areas, where it may be blended with other products (such as ethanol) to meet government specifications. Gasoline is then delivered by tanker truck to individual gasoline stations.

Some retail outlets are owned and operated by refiners, while others are independent businesses that purchase gasoline for resale to the public. The price on the pump reflects both the retailer's purchase cost for the product and the other costs of operating the convenience store. It also reflects local market conditions and factors, such as the desirability of location and the marketing strategy of the owner.

The cost of doing business by individual dealers can vary greatly depending on where the dealer is located. These costs include wages and salaries, benefits, equipment, lease or rent payments, insurance, overhead, and state and local fees. Even retail stations next to each other can have different traffic patterns, rent, and sources of supply that affect their prices. The number and location of local competitors can also affect prices.

Why gasoline prices fluctuate.

Retail gasoline prices are mainly affected by crude oil prices and the level of gasoline supply relative to demand. Strong and increasing demand for gasoline and other petroleum products in the United States and the rest of the world can place intense pressure on available supplies. Even when crude oil prices are stable, gasoline prices fluctuate because of seasonal demand and because of local retail station competition. Gasoline prices can change rapidly if something disrupts the supply of crude oil or if there are problems at refineries or problems with delivery pipelines.

Seasonal demand for gasoline affects prices. Retail gasoline prices tend to gradually rise in the spring and peak in late summer when people drive more frequently. Retail gasoline prices then drop in the winter. Warmer weather and vacation driving generally cause U.S. summer gasoline demand to average about 7% higher than demand during the rest of the year. Gasoline formulations and specifications also change seasonally. Environmental regulations require that gasoline sold in the summer be less prone to evaporate during warmer weather. This means that refiners must replace cheaper but more evaporative gasoline components with less evaporative but more expensive components. From 2004 to 2014, the average monthly price of U.S. retail regular gasoline in June, July, and August was about 47 cents per gallon higher than the price in January.

Changes in the supply and cost of crude oil are major factors in gasoline pricing. Events in crude oil markets that caused spikes in crude oil prices were a major factor in all but one of the five major run-ups in gasoline prices between 1992 and 1997. Rapid gasoline price increases occurred in response to crude oil shortages caused by the Arab oil embargo in 1973, the Iranian revolution in 1978, the Iran/Iraq war in 1980, and the Persian Gulf War in 1990.

World crude oil prices reached record levels in 2008 as a result of high worldwide oil demand relative to supply. Other factors that contribute to higher crude oil prices include political events and conflicts in some major oil producing regions, as well as other factors such as the declining value of the U.S. dollar (the currency at which crude oil is traded globally).

Crude oil prices are determined by worldwide supply and demand, with significant influence by the Organization of Petroleum Exporting Countries (OPEC). OPEC has significant influence on world oil prices, because its members produce about 40% of the world's crude oil. OPEC members are also the only countries that have spare production capacity and the ability to bring more oil into production relatively quickly. Since it was organized in 1960, OPEC has tried to keep world oil prices at a target level by setting production levels for its members.

Rapid gasoline price increases occur in response to crude oil shortages, such as the Persian Gulf War. Gasoline price increases in recent years have been due in part to OPEC crude oil production cuts, turmoil in key oil producing countries and problems -with petroleum infrastructure within the US.

The supply of gasoline is a function of crude oil supply and refining, imports of refined gasoline, and gasoline inventories (stocks). Stocks are the cushion between major short-term supply and demand imbalances, and stock levels can have a significant impact on gasoline prices.

If refinery or pipeline problems and/or reductions in imports cause supplies to decline unexpectedly, gasoline inventories (stocks) may drop rapidly. This drop in inventories may cause wholesalers to bid higher for available supply over concern that future supplies may not be adequate.

Imbalances have also occurred when a region has changed from one fuel type to another as refiners, distributors, and marketers adjust to the new product.

Gasoline may be less expensive in one summer when supplies are plentiful vs. another summer when they are not. These are normal price fluctuations, experienced in all markets.

However, prices of basic energy (gasoline, electricity, natural gas, heating oil) are generally more volatile than prices of other commodities. One reason is that consumers are limited in their ability to substitute between fuels when the price for gasoline, for example, fluctuates. So, while consumers can substitute readily between food products when relative prices shift, most do not have the option in fueling their vehicles.

Gasoline prices differ according to region.

Source: U.S. Energy Information Administration (EIA)